Image

Dedham, MA – The increase of property documents recorded in Norfolk County, when comparing August 2024 to August 2023, indicates healthy real estate activity, Norfolk County Register of Deeds William P. O’Donnell said earlier this week.

“The rise in recorded documents indicates a healthy level of real estate activity," said Register O'Donnell. He noted that in August, there were significant increases in lending activity, real estate sales, and transfers.

"[W]e are seeing pockets of the market here in Norfolk County that are seeing growth and stability, particularly in certain neighborhoods and property types,” stated Register O’Donnell. “It will be important to monitor if this positive trend persists in the coming months.”

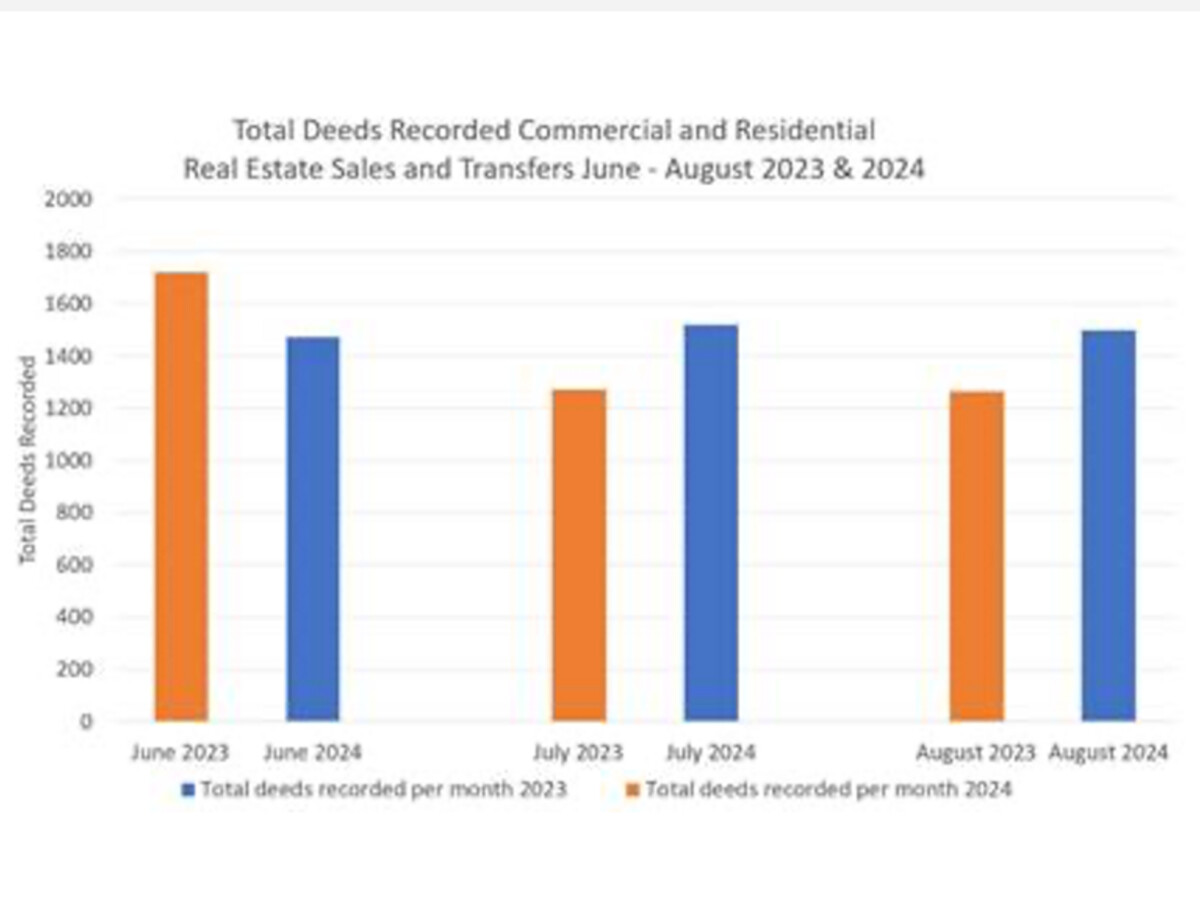

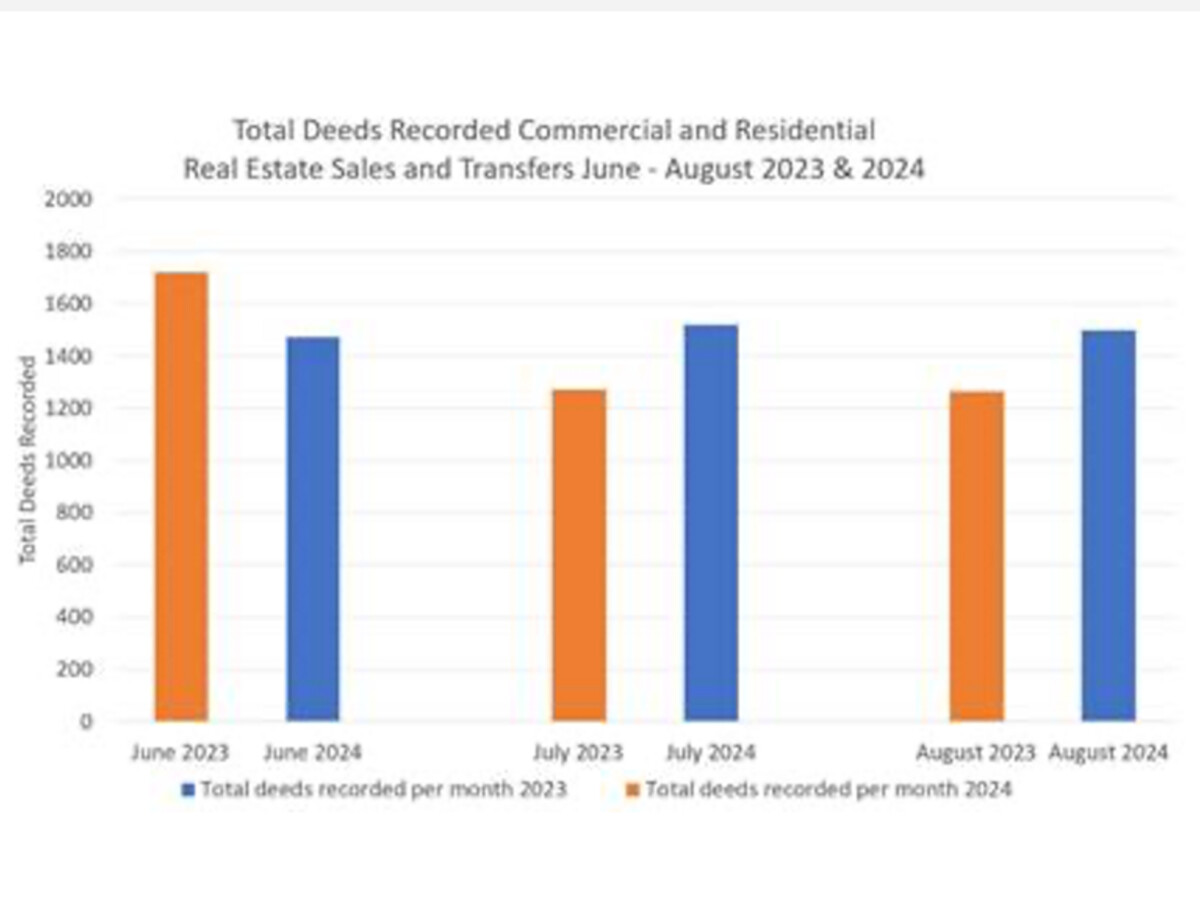

The total number of deeds recorded, an indicator of property sales, increased 19 percent.

Along with number of deeds recorded, the total dollar volume and average sale price of commercial and residential properties have also risen. The average sale price rose 14 percent. The total dollar volume rose 36 percent.

But while the number of property sales are increasing, the market remains difficult for buyers, especially first-time home buyers. Register O'Donnell points to limited inventory and increased property prices as the reasons.

The number of foreclosures has slightly increased. While there were 3 foreclosures in Norfolk County in August 2023, there were 10 foreclosures this August. Additionally, notices to foreclose rose from 22 in August 2023 to 34 in August 2024.

“The number of these notices is troubling. It suggests that more of our neighbors may have financial difficulties in the future,” said O'Donnell.

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs and NeighborWorks Housing Solutions to help anyone facing challenges in paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

“If you are having difficulty paying your monthly mortgage, please consider contacting one of these non-profit agencies for help and guidance,” said O’Donnell.

Residents in need of assistance can also contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email registerodonnell@norfolkdeeds.org. They can visit the registry's Facebook page at facebook.com/norfolkdeeds or follow it on Twitter or Instagram at @norfolkdeeds.

Thanks to the Norfolk County Registry of Deeds for contributing this news to Westwood Minute.