Image

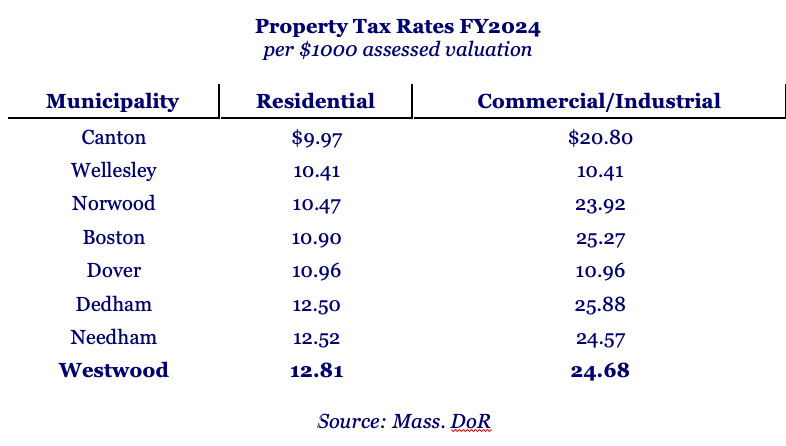

Editor’s note: The chart below is a small sampling of tax rates of area municipalities. To review other rates not specifically listed, click the reference link to Department of Revenue, below the article.

By Peter T. Ittig, Ph.D, Contributor

During the fall, the Massachusetts Department of Revenue receives and approves new tax rates for the 352 municipalities in Massachusetts. Most have now been approved, including Westwood on December 7, Needham on December 8, and Norwood on December 14. See below for a comparison of some of the approved rates for FY2024.

These rates include the effect of both the new total tax levy, including overrides, and the new property assessments.

Tax bills will be issued soon to homeowners in Westwood using the new tax rates. These will be “actual” or final quarterly bills for Fiscal Year 2024. Payment of these “actual” bills is normally due on February 1st and May 1st.

See,

https://dlsgateway.dor.state.ma.us/reports/rdPage.aspx?rdReport=Tracking.TaxRateFormStatus

Thanks to Professor Peter Ittig for contributing this news to Westwood Minute. Professor Ittig was a member of the of the Westwood Finance & Warrant Commission from 2019 to 2022.

Partly Cloudy , with a high of 36 and low of 20 degrees. Partly Cloudy during the morning, overcast for the afternoon, clear overnight.

This is progress and I am glad to see the Select Board moving in the right direction. However, a majority of voters at last Monday's Special Town Meeting voted to recommend that the Select Board immediately cease its lawsuit against the Westwood Land Trust.

What is the citizen's petition about? I checked the town website, and the only information I could find on town meeting articles was from last year. The public hearing dates for 2026 are posted as February 24-25.

Apparently, you need to submit a public records request through the town's FOIA portal. What a shame, since it should have been posted to the town website upon certification of petition signatures.

Westwood Minute has obtained a copy of the petition and has added a short description of it to the article. A copy of the petition is attached below the article.