Image

The following opinion article represents the views and opinions of the author, and not necessarily those of Westwood Minute.

By Peter T. Ittig, Ph.D.

The annual Westwood Town Meeting will be held on Monday, May 6th at the High School starting at 6:30 p.m. Articles to be voted on will have consequences for taxes and spending.

Approval of the budget and supplemental financial articles at the Town Meeting will result in a projected increase in residential property taxes of 3.5% as shown in the table on page 85 of the Warrant Book from the Finance & Warrant Commission (FinCom). This is in addition to the property tax increase of 12.55% for the current fiscal year (FY2024) and 6.8% for the prior fiscal year (FY2023), also shown in that table.

Voters who would like to mitigate the proposed tax increase for the coming year might consider opportunities in the Warrant to reject or postpone some spending proposals by voting down the related articles. Rejection of the Operating Budget in Article 3 would be disruptive, but there are supplemental spending proposals that might be postponed or otherwise funded. See the section on spending below for comments on the financial articles.

The proposed budget again calls for the maximum property tax increase permitted by state law (in proposition 2½). As a consequence, the budgeted “unused tax levy” is $0 for FY2025. This is shown in the table on page 84 of the Warrant Book. The budgeted “unused tax levy” is typically very small, i.e. the tax increase is generally at or very near the upper limit of the amount permitted by law. [Note: The historical numbers on that line are not comparable since the budgeted number is adjusted later for new taxable construction that occurs during the fiscal year.]

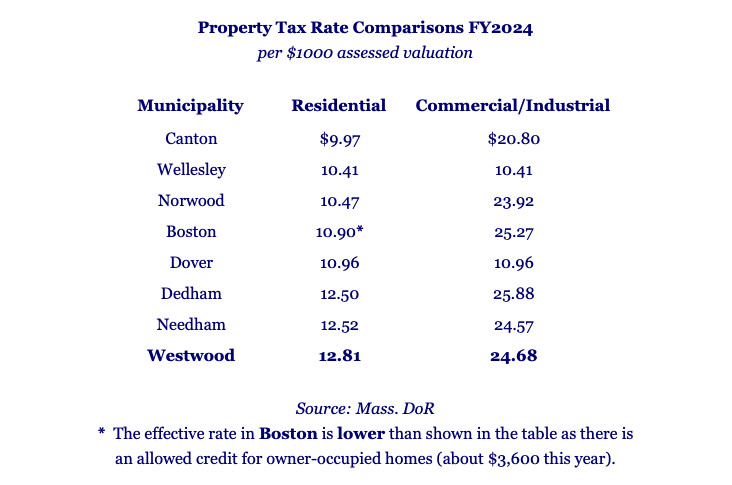

Westwood continues to have relatively high property taxes as shown in the table below.

Voters who would like to mitigate the proposed tax increase for the coming year might consider opportunities in the Warrant to postpone or transfer some spending by voting down the related articles. Since the Tax Levy is about $100 million, a change of $1 million in spending is equivalent to about 1% of the Tax Levy. There are no new overrides at this time, but several are in the works.

Rejection of the Operating Budget in Article 3 (page 18) would be disruptive, but there are supplemental spending proposals in Warrant articles 4,5,8,10,12 and 13 that might be postponed or otherwise funded. Some of these items, including the school capital spending and maintenance proposed in articles 5 and 12, would probably not be there at all if the Hanlon/Pinehill construction project had not incurred substantial cost overruns that required the transfer of funds that could have been used for other purposes. For example, the Select Board transferred about $2.1 million in Federal ARPA funds to cover part of the cost overruns on the Hanlon/Pine Hill School. Another $2 million was transferred from a reserve fund called the University Station Mitigation Fund to the building project.

Any individual items that are urgent may be covered by the Select Board using reserve funds including the Stabilization Fund (article 9), which currently holds about $4 million, and the Capital Stabilization Fund, which currently holds about $1.6 million. The School Committee and the Select Board have separate reserve funds.

The optional/supplemental spending proposals include:

Article 4, page 19: $1.3 million for municipal capital improvements, including $150k for “facility maintenance”.

Article 5, page 20: $1 million for school capital improvements, including $250k for “roofing”.

Article 8, page 22: $0.5 million for “additional capital improvements”.

Article 10, page 23: $1.6 million for the “OPEB” pension benefits trust fund. This is an investment fund that holds advance payments of certain pension related obligations. It currently holds about $21 million, about half of the amount needed for 100% advance funding. Another contribution is not required now, but over the long term it would be prudent to reduce the “unfunded” pension liability. The current funding schedule is ambitious and expensive.

[Note: Advance funding of pension obligations is more important for businesses (as they may cease to exist) and is required. The US Federal Government does not do this. Local governments generally partially fund their future pension obligations.]

Article 12, page 24: $2.5 million for high school “roof restoration borrowing.” Westwood has a chronic problem with maintenance of buildings, allowing some to deteriorate to the point that they need major repairs or need to be replaced. Building maintenance should be covered by sufficient amounts in the operating budget rather than treated as supplemental capital items sometimes requiring borrowing. However, the roof should be repaired.

Article 13, page 25: $1.5 million for the Conant Road Culvert. The FinCom was split on this item, voting 7 in favor and 6 opposed. It might reasonably be deferred to next year.

Article 21, page 35: Zoning for High-Density Multi-Family Housing

The most controversial article at the Town Meeting is the proposal for zoning to allow high-density multi-family housing in some parts of Westwood. See my separate discussion of Article 21 in the Westwood Minute at,

Cost Overruns on Hanlon/Pinehill School

Thanks to Professor Peter Ittig for contributing this opinion article to Westwood Minute. Professor Ittig was a member of the of the Westwood Finance & Warrant Commission from 2019 to 2022.

Westwood Minute takes no position on the opinion articles that it publishes, but seeks accurate and thoughtful commentary on topics that matter to our community, from a variety of differing viewpoints. Feel free to reply with your reaction below, or submit another perspective to WestwoodInAMinute@gmail.com.