Image

The following opinion article represents the views and opinions of the author, and not necessarily those of Westwood Minute.

By Professor Peter T. Ittig

At the Town Meeting on May 1st voters will be asked to approve a budget for FY2024 that will increase our tax bills by about 7.25% as shown on page 86 of the Warrant (see the line labeled “Average Tax Bill Increase”). This is in addition to the increase of about 6.8% for the current fiscal year (shown on the same line) which did not include the effect of the Hanlon override.

Once again, the budget is formed from the maximum increase in the tax levy permitted by state law (in Proposition 21⁄2). The entry of $200k for the budgeted “unused tax levy” for FY2024 (page 82 of the Warrant) is essentially rounding noise on a budget of over $121 million.

[Note: The historical numbers on that line are not comparable and are confusing as they are adjusted the following year to include unanticipated new growth. For example, the budgeted “unused tax levy” for the previous fiscal year was $160k (shown on the Warrant for the previous year) not $795k (as shown on page 82 of the new Warrant).]

If the proposed financial articles are passed, the tax increase of about 7.25% is expected to be in our “preliminary” property tax bills issued in July (due on August 1st) and will include the cost of the first payment on the Hanlon bonds (first of 30). Much of the tax increase for the coming year is due to the Hanlon override which has become much more expensive than was expected at the time the override was approved by the voters. This is due both to substantial construction cost overruns and due to much more expensive financing than expected. However, the large increase in costs for the Hanlon (now Pine Hill) School is not shown in the proposed budget. It is disappointing that the Finance Commission and the Select Board did not make more of an effort to mitigate the large tax increase this year.

The Hanlon construction cost overrun is now more than $4 million over the amount that was authorized by the voters. The Select Board and the School Committee have allowed this additional spending and have allocated funds from various accounts to cover it without seeking further authorization from the voters. The funds that have been allocated could have been used for other purposes including proposed spending items in the Warrant. The allocated funds included school “rainy day” funds and Federal “American Rescue Plan Act” (Covid) funds.

The cost of financing the Hanlon School has also turned out to be much more expensive than was projected at the time of the override. An interest rate of 3.7% was obtained on the Hanlon bonds rather than the 2% estimate provided to the voters. The annual cost estimate given to voters in the Warrant for the override (page 10 of that Warrant) was $55 per $100 thousand of home assessed value for 30 years. That cost will be about 26% higher solely due to the higher interest rate.

More overrides are coming. There is a proposed $10 million bailout for the Hale Reservation in exchange for a conservation restriction. The Select Board decided to postpone this issue to next year. Additional overrides are being planned for the Sheehan school and the fire station. Sheehan School new construction costs were estimated to range from $50 to $60 million in 2020. Also proposed is a new main fire station for an estimated construction cost of $15 million. There may be more. The School Committee has shown a preference for tearing down and replacing all school buildings on a rotating schedule.

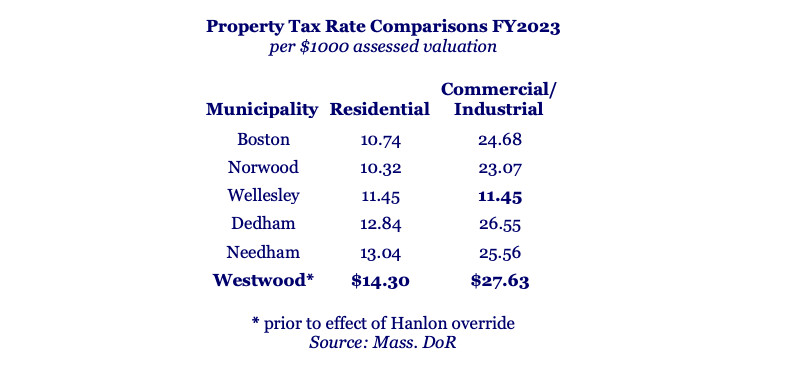

Westwood property taxes continue to be high relative to nearby towns. See comparison table below for current tax rates before the effect of the Hanlon override.

Westwood seniors on relatively fixed incomes have been suffering from the high and rapidly rising property taxes in Westwood. Last year the Select Board supported an article providing a Town contribution to the Aid to Elderly & Disabled fund of $300k that is not being repeated in the Warrant this year.

Voters who would like to mitigate the proposed large tax increase for the coming year might consider opportunities in the Warrant to postpone some spending by voting down the related articles. Rejection of the Omnibus Operating Budget in Article 3 would be disruptive, but there are spending proposals in Warrant articles 4, 5 and 11 for optional spending items that might be postponed. Some of these items, including the school capital spending in article 5, would probably not be there at all if the Hanlon construction had not incurred substantial cost overruns and resulted in the reallocation of available funds. Any individual items that are urgent may be covered by the Select Board using reserve funds including the Stabilization Fund (article 10), which currently holds about $4 million, and the Capital Stabilization Fund, which currently holds about $1.6 million.

The optional spending items include:

Article 4, page 22: $1.355 million for municipal capital improvements.

Article 5, page 23: $1.017 million for school capital improvements.

Article 11, page 27: $1.54 million for the “OPEB” pension benefits trust fund. This is an investment fund that holds advance payments of certain pension related obligations. It currently holds about $18 million. Another contribution is not required now, but over the long term it would be prudent to reduce the “unfunded” pension liability. The current funding schedule is ambitious and expensive. [Note: Advance funding of pension obligations is more important for businesses (as they may cease to exist) and is required. The US Federal Government does not do this. Local governments generally partially fund their future pension obligations.]

Related Links:

Related articles:

Professor Ittig was a member of the of the Westwood Finance & Warrant Commission from 2019 to 2022. Thanks to Professor Ittig for contributing this opinion article to Westwood Minute.

Westwood Minute takes no position on the opinion articles that it publishes, but seeks accurate and thoughtful commentary on topics that matter to our community, from a variety of differing viewpoints. Feel free to reply with your reaction below, or submit another perspective to WestwoodInAMinute@gmail.com.

Thank you Peter for your helpful analysis. Westwood needs to fund the much needed requisite staffing for WFD and that is not included in this FY24 budget. There are some lofty salaries being paid at the administrative level. Here is a link with specific administrative salaries https://www.townhall.westwood.ma.us/home/showpublisheddocument/27598/638127569330400000

Great to see that folks are feeling free to comment on this platform! Yesterday, I just composed some guidelines for community postings, and with any new conversation that pops up, I'll be posting them so we're all on the same page as to what to expect when sharing on Westwood Minute. Feel free to click on the heading above for the complete posting, and a shorter summary is copied here:

Westwood Minute Community Conduct Guidelines:

1. State your opinion/reply/comment respectfully.

2. Give other community members the benefit of a doubt. You deserve the same.

3. Keep comments constructive and argue the issue, rather than attack the person.

4. Disagreeing, taking an unpopular position, or arguing a point are NOT reasons for removal. However, personal attacks, profanity, self-serving promotions, and discriminatory or inflammatory remarks are subject to removal.

5. Confusing posts may be removed to keep postings relevant and useful to readers.

6. If you have any questions or concerns, reach out and email WestwoodInAMinute@gmail.com.

Thanks, neighbors, for taking the time to share your thoughts.