Image

Thanks to Norfolk County Registry of Deeds for contributing this news to Westwood Minute.

Real estate activity in Norfolk County continued its upward trend in September 2025, with increases in mortgage recordings and property transactions over the same period last year, announced Norfolk County Register of Deeds William P. O’Donnell from Dedham in October.

“The year-over-year growth in property sales shows that the market remains active,” noted Register O’Donnell. “Buyers and sellers continue to move forward with transactions despite broader economic conditions. This steady level of activity demonstrates confidence in the local real estate landscape and suggests that Norfolk County remains a desirable place to live and work.”

The Norfolk County Registry of Deeds recorded a total of 9,511 documents in September 2025, an 11% increase from the same month last year. Compared to last month, however, it is a 5% decrease.

“The increase in overall document recordings compared to last September is a strong indicator of continued engagement in the real estate market,” stated Register O'Donnell. “This continued engagement and momentum in the market reflects confidence among buyers, sellers, and lenders."

The total number of deeds recorded for September 2025, which includes both commercial and residential real estate sales and transfers, was 1,396. This is up 7% from September 2024, but down 10% from August 2025. Looking at just real estate sales, 684 properties were sold in September, representing a 5% increase compared to the same time last year.

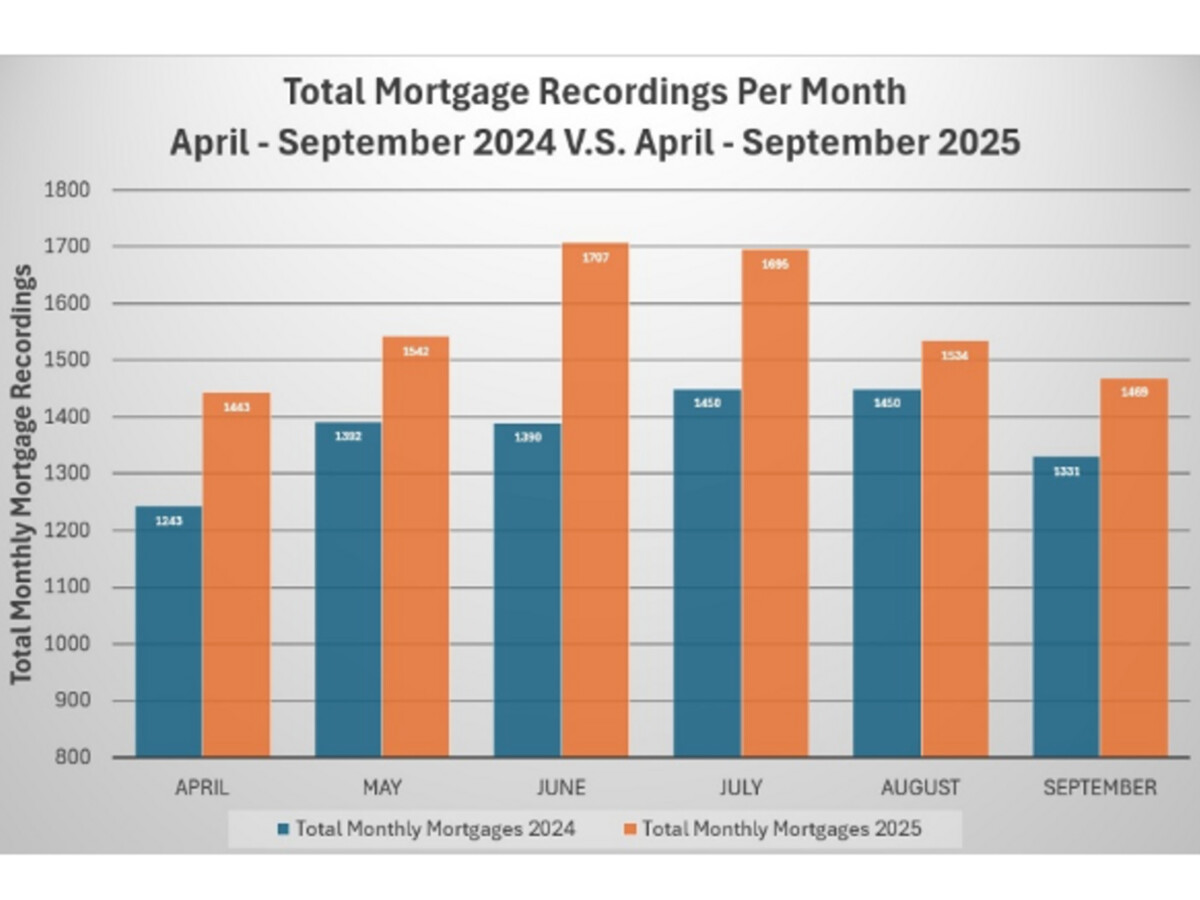

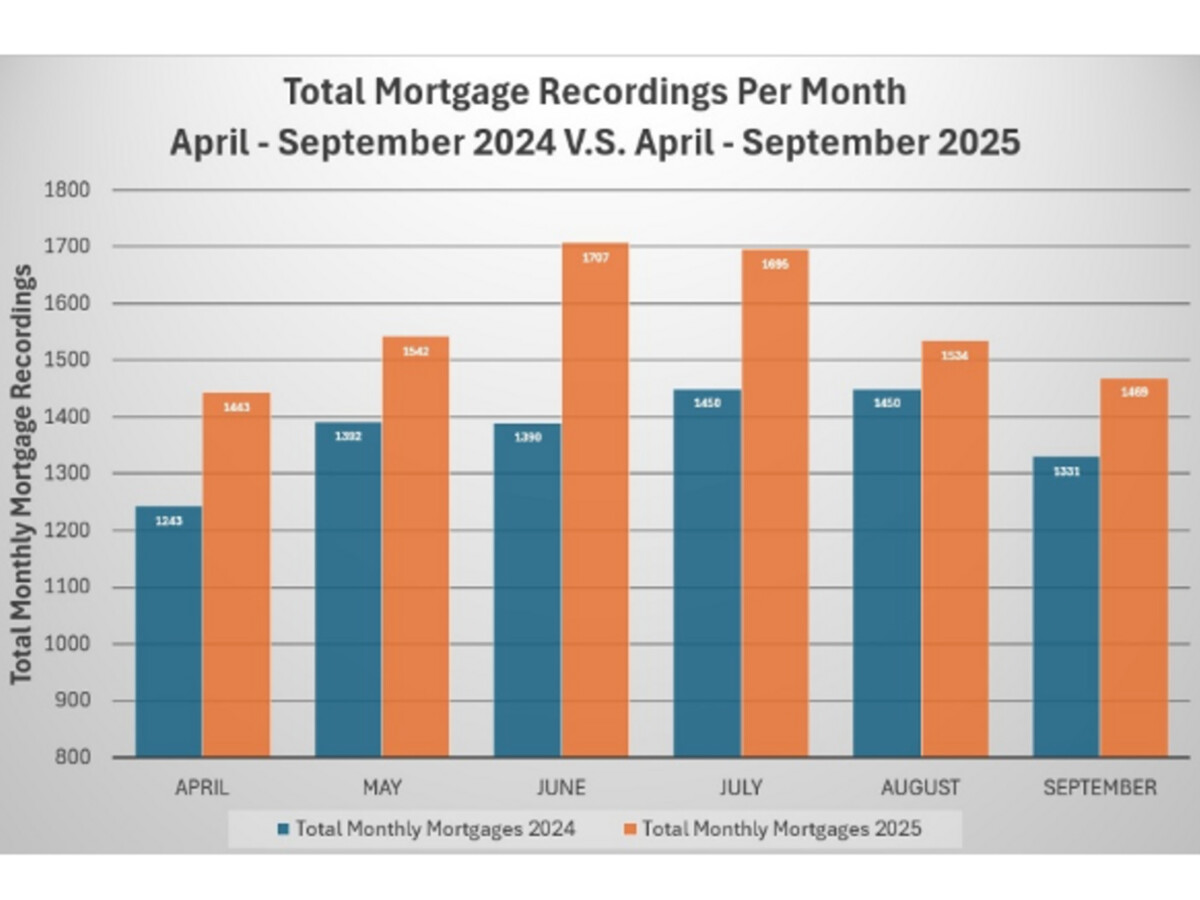

In addition to increased deed recordings, lending activity also saw growth. A total of 1,469 mortgages were recorded in September 2025, up 10% from September 2024, though down 4% from August 2025. The total dollar amount of mortgage indebtedness recorded in September was $1,286,464,631, a 61% increase compared to the $797,674,694 recorded in September 2024.

“The growth in mortgage recordings compared to last year shows a large number of people are still successfully navigating the market to secure financing,” said Register O’Donnell. “Alongside this increase in mortgage recordings there was also a significant rise in the total amount of borrowing and investment. This reflects that residents remain committed to making substantial financial investments in their current properties, as well as purchasing new homes.”

The average sale price of commercial and residential properties in September 2025 was $967,211.86, an increase of 1% from September 2024, and a 6% decrease from August of this year. The total dollar volume of commercial and residential sales in September was $661.6 million, a 5% increase compared to September of last year.

“The slight increase in average sale price compared to last year may reflect increased demand and competition in certain area communities,” noted Register O’Donnell. “However, it is encouraging to see values holding steady. This consistency in pricing could help individuals who have been saving and waiting for the right time to enter the market.”

Foreclosure activity in September 2025 remained low. There were 6 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, down from the 7 recorded in September 2024. Additionally, 23 notices to foreclose were filed, a decrease from the 28 notices recorded in September of last year.

“There is no question that this reduction in the number of foreclosures and notices to foreclose is good news,” said Register O'Donnell. “However, we must remember that foreclosure activity affects real people and I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org.”