Image

Thanks to Norfolk County Registry of Deeds for contributing this article to Westwood Minute.

Dedham, MA – Norfolk County Register of Deeds William P. O’Donnell reported that real estate activity in Norfolk County remained strong in December 2025, with increases in both Deed and mortgage recordings compared to last year.

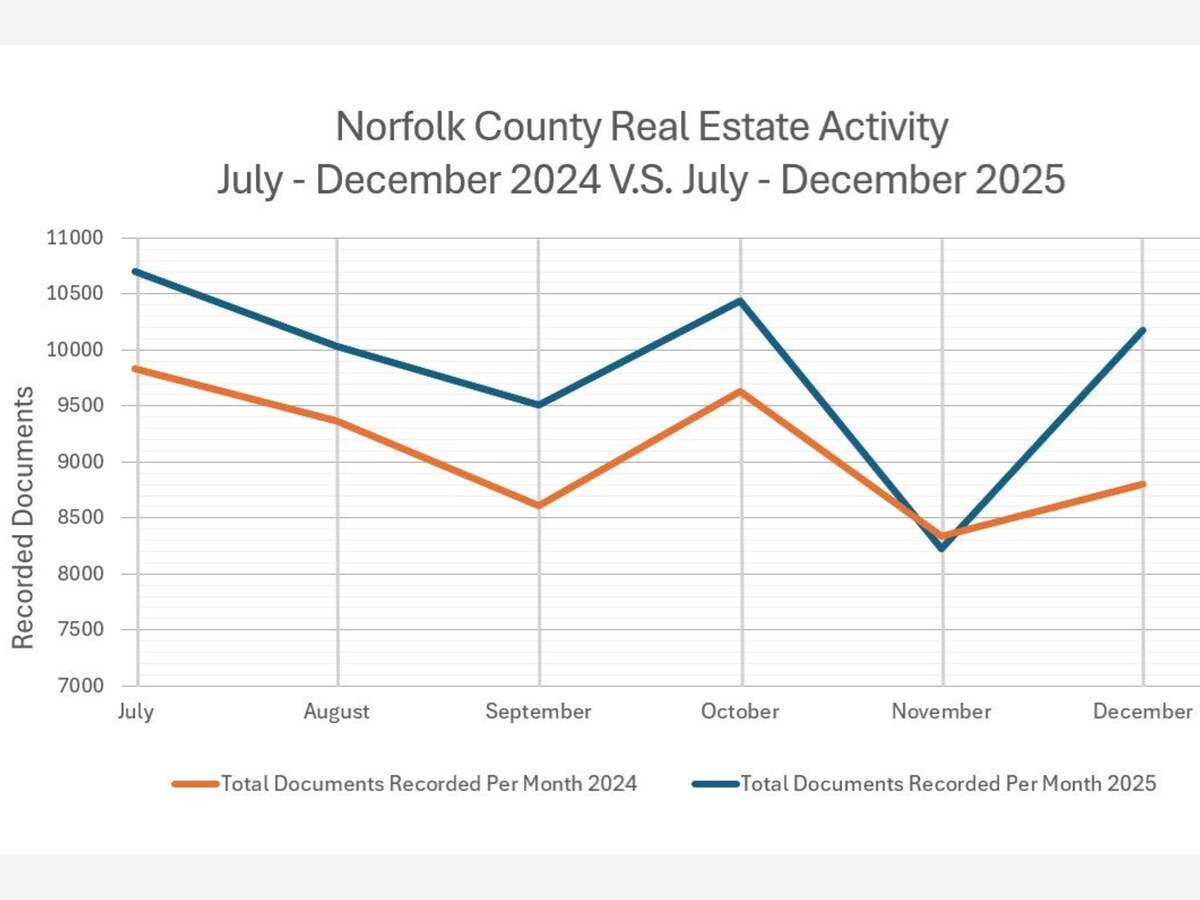

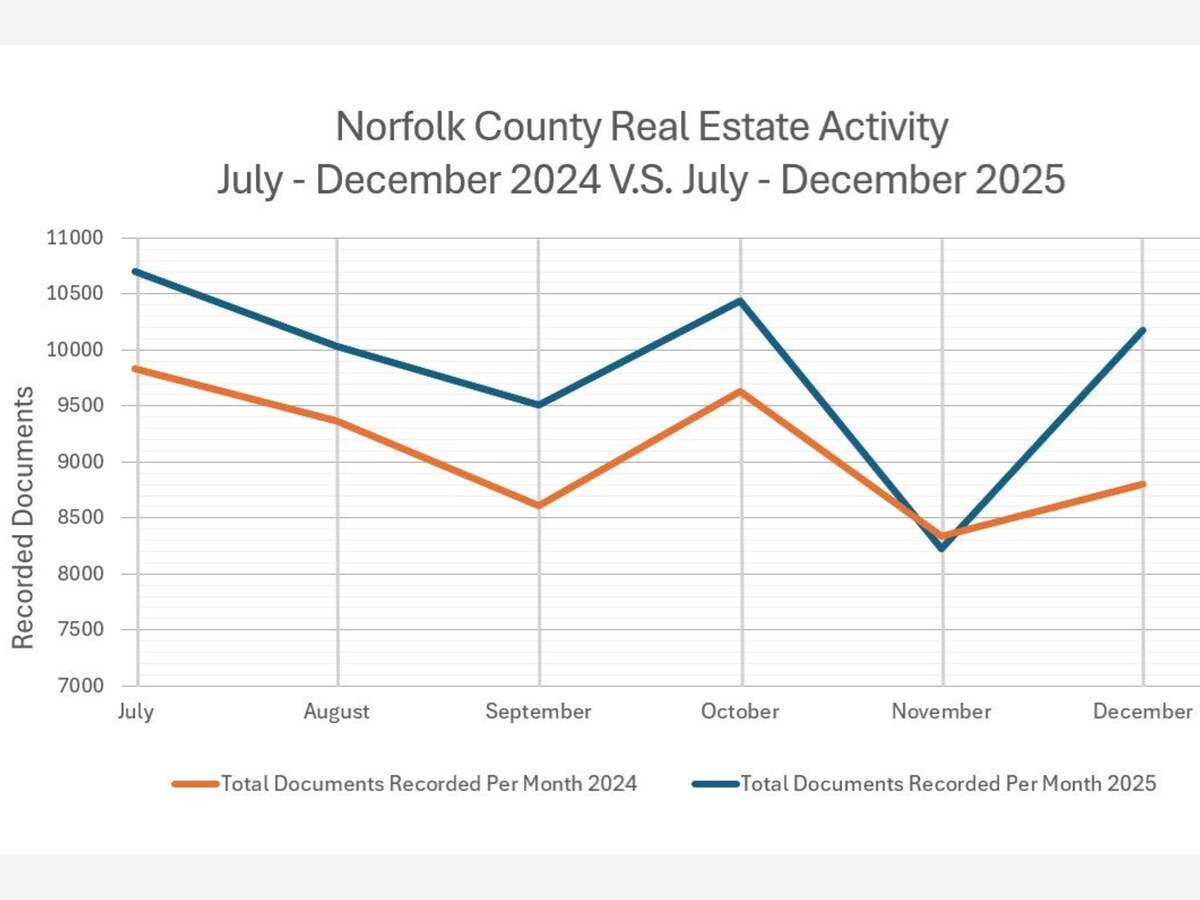

The Norfolk County Registry of Deeds recorded a total of 10,178 documents in December 2025, a 16% increase from December 2024 and a 24% increase from November 2025.

“The increase in overall document recordings compared to last December is a strong indicator of continued engagement in the real estate market,” stated Norfolk County Register of Deeds, William P. O'Donnell. “This level of activity reflects confidence among buyers, sellers, and lenders as we close out the year.”

The total number of deeds recorded in December, which includes both commercial and residential real estate sales and transfers, was 1,545, up 13% from December 2024 and 25% higher than November 2025. Looking at just real estate sales, 745 properties were sold, an 11% increase compared to last year.

“The year-over-year growth in property transactions highlights that the market remains active,” noted Register O’Donnell. “Buyers and sellers continue to move forward with transactions despite broader economic conditions. This steady level of activity demonstrates confidence in Norfolk County’s real estate landscape.”

The average sale price of commercial and residential properties in December 2025 was $1,437,216, an 18% decrease from December 2024, but a 2% increase from November 2025. The total dollar volume of commercial and residential sales in December was $1.07 billion, down 10% compared to last year, but up 27% from November.

“This reduction in overall real estate prices compared to last year may offer some relief to those looking to purchase property in Norfolk County,” said Register O’Donnell. “Lower average sale prices could create new opportunities for first-time homebuyers and current homeowners looking to move who were previously priced out of the market. However purchase prices remain high relative to past years”

Lending activity also showed strong performance. A total of 1,753 mortgages were recorded in December 2025, up 29% from December 2024 and 25% higher than November 2025. The total dollar amount of mortgage indebtedness recorded in December was $1,280,227,467, a 12% increase compared to last year and 28% higher than the previous month.

“The increase in mortgage recordings and the rise in total mortgage indebtedness reflect continued investment in real estate,” said Register O’Donnell. “These figures show that many residents are successfully securing financing and making substantial commitments to homeownership and property improvements.”

The foreclosure market in Norfolk County saw positive developments during December 2025. There were 4 foreclosure deeds recorded as a result of mortgage foreclosures taking place in Norfolk County, down from 6 recorded in December 2024. Notices to foreclose also declined significantly, with 11 notices recorded in December this year compared to 33 during the same time period last year, a 67% decrease.

“Any reduction in foreclosure activity is positive news,” said Register O'Donnell. “With that said, we must remember that foreclosure activity has a human impact, and there are still a number of our neighbors who have lost their homes, and even more are dangerously close to losing their homes. I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org.”

For the past several years, the Norfolk County Registry of Deeds has partnered with Quincy Community Action Programs (617-479-8181 x376) and NeighborWorks Housing Solutions (508-587-0950) to help anyone facing challenges paying their mortgage. Another option for homeowners is to contact the Massachusetts Attorney General’s Consumer Advocacy and Response Division (CARD) at 617-727-8400.

“The positive trends we have seen in December underscore the resilience and continued desirability of Norfolk County as a place to live, work, and invest,” said Register O'Donnell. “Despite fluctuations in the broader economy, the local real estate market has shown strength across key indicators including property sales, mortgage activity, and pricing adjustments that may improve affordability. This momentum reflects confidence in our communities as we move into the new year.”

To learn more about these and other Registry of Deeds events and initiatives, follow the registry on Facebook at facebook.com/norfolkdeeds, and on Twitter and Instagram at @norfolkdeeds.

The Norfolk County Registry of Deeds, located at 649 High St., Dedham, is the principal office for real property in Norfolk County. The Registry is a resource for homeowners, title examiners, mortgage lenders, municipalities, and others with a need for secure, accurate, and accessible land record information. All land record research information can be found on the Registry's website, www.norfolkdeeds.org. Residents in need of assistance can contact the Registry of Deeds Customer Service Center at (781) 461-6101 or email us at registerodonnell@norfolkdeeds.org.