Image

The following opinion article is by Professor Peter T. Ittig, a member of Westwood's Finance & Warrant Commission (FinCom). The ideas and opinions expressed here represent those held by Professor Ittig, alone. They should not be taken as necessarily representative of those held by FinCom or by Westwood Minute.

By Peter T. Ittig, Ph.D.

The Westwood Town Meeting is scheduled for Monday May 2 at the High School. Highlights include votes on a budget of about $112 million and several additional items including three articles concerning property tax relief for senior homeowners. Additional articles from the Planning Board include zoning changes to permit high density housing near train stations and bus stops. My recommendations differed from those of my colleagues on some of these items.

Relief for Senior Homeowners

There are three articles concerning property tax relief for senior homeowners. One article is a proposal from the Select Board (Article 11) for a one-time contribution to the Westwood Aid to the Elderly & Disabled charity. The other two articles are Citizen Petitions in Articles 13 & 14 that were sponsored by over 50 Westwood residents concerning the possible permanent adoption of exemptions for senior homeowners that are permitted by the state and offer partial state reimbursement. The second of those Citizen Petitions, Article 14, is the important one and was intended to replace the earlier petition from a year ago. The Select Board Article 11 appears to be a response to the Citizen Petition articles but is only a one-year adjustment.

I encourage voters to support both the Select Board proposal in Article 11 and Citizen Petition Article 14 that refers specifically to the clause 41C1/2 exemption. A member of the Westwood Council on Aging referred to the exemption proposal as “an article that acknowledges, supports and values having and keeping seniors in our Town.”

If you are a senior citizen taxpayer, I urge you to show up for this Town Meeting on May 2nd and encourage your friends to do so as well. This is a rare opportunity to address the long-standing issues concerning tax relief for senior homeowners and obtain a durable adjustment. The Select Board anticipates a small voter turnout and has reduced the quorum for the meeting. The choice to hold the meeting indoors may discourage some citizens from participating. However, this is an opportunity that will probably not come again any time soon. Your participation is very important.

Taxes

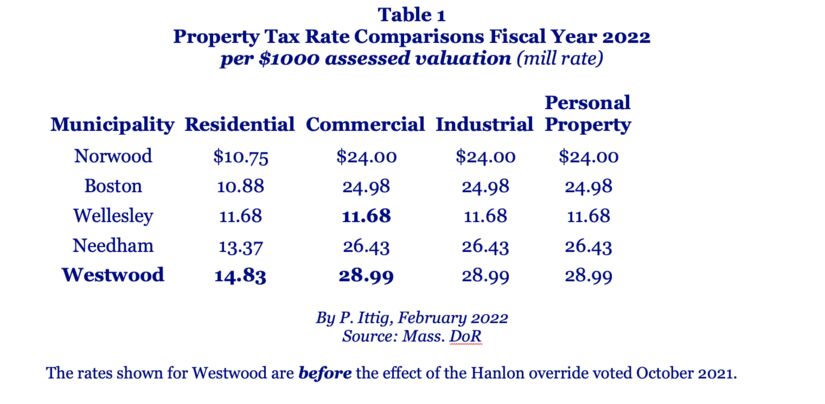

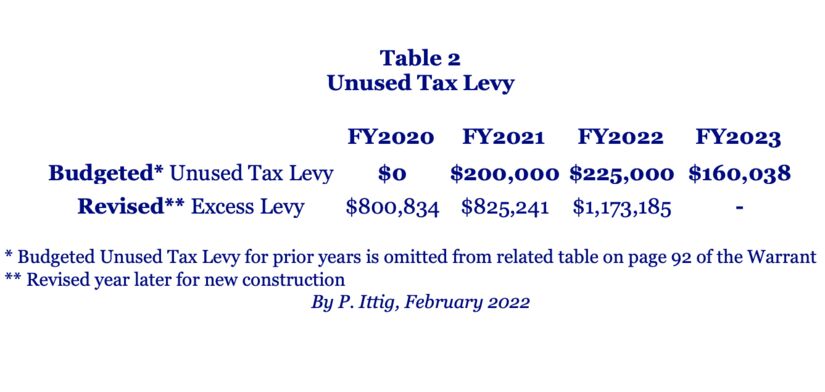

Westwood property taxes continue to be high in comparison with other communities as shown in Table 1. The proposed budget will increase property taxes on homes by an average of about 2.5%, which does not include the effect of the Hanlon override. The tax increase is again very close to the legal limit with a Budgeted Unused Tax Levy of $160 thousand. It was exactly zero in FY2020 as shown in Table 2, meaning that every dollar of permitted tax without an override was used. A Budgeted Unused Tax Levy of $160 thousand looks better but is essentially zero plus rounding noise on a budget of over $112 million. About half of spending will go to the schools which cost about $20 thousand per student per year. The school budget includes an expansion of the METCO program from about 51 students to 87 students, though the costs of that expansion are not reported separately.

Coming attractions for next year include a possible override to rebuild the Sheehan School. The state has rejected state aid for this project once, but a second request is being submitted. Also coming is a probable request for $10 million for a bailout of the Hale Reservation in exchange for a conservation restriction of some sort. Also next year, the Hanlon override will show up on your tax bill after the construction bonds are issued.

It is my recommendation that Westwood should try to restrain tax increases until property tax rates are not the highest of those shown in Table 1. Comparatively high tax rates influence location decisions for both businesses and individuals and are felt acutely by senior homeowners on relatively fixed incomes.

Planning Board Articles

Planning Board Article 22 concerns zoning changes to permit high density housing within a half mile of train stations and bus stops (“Mixed Use and Multi-Family Residence Overlay District”). In my opinion, the Planning Board has done an excellent job in a difficult situation to meet the requirements of a new state law that requires towns to allow high density housing near train stations and bus stops. The Planning Board should be commended for their efforts. There was considerable resistance to these changes in the Finance Commission. Some of my colleagues favor refusing to comply with the new law until we find out how severe the penalties will be for failure to comply. I agree with the Planning Board determination that the Town should make a good faith effort to comply with the new law now, and I recommend approval of Planning Board Article 22.

Background on Relief for Senior Homeowners

A basic issue concerns whether we should increase amount of assistance granted to senior homeowners beyond that now available from the Aid to the Elderly & Disabled charity, and whether this assistance should be at the discretion of the Select Board each year or should be given to all who meet the requirements of a state authorized exemption that provides partial state reimbursement.

The Select Board apparently agrees that we should do more as they proposed to contribute a larger amount to the Aid to the Elderly & Disabled charity for this year only. However, that $300 thousand contribution is a one-time contribution, remains discretionary and will probably be much smaller next year. In recent years, the Select Board has only contributed about $50 thousand per year to that fund from the Select Board Reserve. It is probably not a coincidence that the Select Board proposed a larger contribution this year and that the amount proposed is similar to the amount that would be provided by the proposed adoption of the state authorized exemptions in Citizen Petition Article 14.

Citizen Petition Article 14 would have Westwood accept the more generous assistance permitted by the state in the so-called Clause 41C1/2 exemption. I estimate this to be worth about $2500 for those eligible in Westwood. I also estimate that the number of exemptions granted in Westwood would rise to about 150. The state offers partial reimbursement for those exemptions.

In comparison, the Westwood Aid to the Elderly & Disabled charity normally assists only about 50 residents per year and provided only $1800 to recipients in the last reported round.

The Clause 41C1/2 exemption will provide more support to more senior homeowners with partial state reimbursement. Also, it is an exemption

available to all senior homeowners who meet the requirements, not a discretionary grant from a charity with limited funds.

An important detail is that the Clause 41C1/2 senior exemption will not take effect this year even if it is approved at the Town Meeting, as it will need to be ratified by the voters at the next Town election. Thus, the $300 thousand contribution to the Aid to the Elderly & Disabled charity, recommended by the Select Board, will provide a helpful bridge to the new exemption and will not be duplicated by it.

Both programs are means tested on income using the limits of the so-called “senior circuit breaker” in the state income tax code. However, the Westwood Aid to the Elderly & Disabled charity also requires that applicants must have a “home value less than the town average” as shown on the application form. The home value requirement alone eliminates about half of the senior homeowners in Westwood, but the greatest limitation is that of limited funds available.

There is some history concerning the proposal for exemptions.

In 2000, the Town proposed to extend assistance to a larger number of senior homeowners beyond that provided by the Aid to the Elderly & Disabled charity which was established in 1999. The Town proposed a partial exemption for senior homeowners meeting certain criteria including means testing on income. The proposed exemption was to be based on a formula for eligibility, not limited by funds contributed. That proposed exemption was proposed by the Select Board, approved by the Finance Commission and approved by the Town Meeting in 2000 as article 14. However, that exemption was never implemented as it was of a type that was not authorized by the legislature at that time and needed state approval.

In 2006 the state approved a very similar option as the Clause 41C1/2 exemption. The state offers partial state reimbursement for towns adopting that exemption. Westwood has ignored it. The proposed Citizen Petition Article 14 would have Westwood adopt that exemption.

The Clause 41C1/2 exemption is very similar to the 2000 Westwood proposal in that it is means tested on income, but with updated limits, and it uses the income test for the so-called “senior circuit breaker” in the state income tax code.

Widows

Citizen Petition Article 14 would also extend the exemption for widows in the Clause 17D exemption by accepting the permitted inflation adjustments. Westwood allows the Clause 17D exemption but at only $175 and granted no exemptions under that clause in FY2020, probably due to severe means testing on assets at $40 thousand and the failure to adopt the inflation adjustments permitted in Clauses 17 E & F. Citizen Petition Article 14 would have Westwood accept those inflation adjustments for the means tests and the exemption amount.

Objections

Some arguments have been raised against adopting the Clause 41C1/2 exemption.

One objection to the proposal is that it complicates budgeting because the cost depends upon the number of qualifying applications, which is not known in advance exactly, and the because the value of the exemption is based upon a formula and may change a bit from year to year.

I spoke with the Finance Director in Ashland about this, where they have adopted the Clause 41C1/2 exemption and have been using it since 2009. It works well for them, and the Ashland Finance Director reported that there are no significant budget complications. She further reported “the exemption amount is estimated until the tax rate is set.” “I simply provide the estimated tax levy to the Assessor and he takes it from there…”.

Other parts of the Westwood budget require estimates including the number of children that will be in the schools in September and the number of snowstorms in the winter. This routine estimation is not a major problem as indicated by the Ashland Finance Director, and this is a small item in comparison with others in the Westwood budget. Once the Clause 41C1/2 program is implemented, the variation from year to year will likely be small, as was the experience in Ashland.

Also, the proposed exemption in 2000 had the same issue concerning the number of applications not known exactly in advance, yet it was approved by the Select Board and by the Finance Commission and by the Town Meeting, without an offer of partial state reimbursement.

I estimated the cost for the first year by extrapolation from the experience of the Town of Ashland, which I shared with the Finance Commission. I projected the cost to be about $350 thousand after state reimbursement. However, I expect the net cost will be somewhat lower in Westwood due to differing average income figures for the towns. In the second and subsequent years, it will be much easier to estimate the cost.

Further, the proposed exemptions could pay for themselves over time because the exemptions will allow seniors to stay in their homes longer. This saves money for the Town because senior homeowners pay property taxes but are light users of Town services and mostly don’t have children in the school system which is much of the Westwood budget. Thus, Westwood benefits by allowing seniors to remain in their homes longer.

Another objection is that “the burden of the tax exemption dollars would shift to other Town residents”. This was also described as “the subsidizing of another’s real estate taxes”.

In fact, if you have children in the public schools, your family is being subsidized even if you pay tax on a million-dollar house, as the property tax on a million-dollar house in Westwood is less than $15 thousand per year, but we spend about $20 thousand per student per year for the schools plus the occasional override for school construction. The cost of the senior center in our budget is only about $132 per senior resident of Westwood.

This means that families with children in the public schools are being subsidized by the senior homeowners who don’t, and there is a vast difference between costs of public services for families with school children and senior homeowners who mostly don’t. The proposed exemptions would slightly reduce the imbalance in costs and benefits and the cross subsidization of homeowners.

One colleague prefers the small circuit breaker credit in the income tax code. However, that credit is means tested on home assessed value as well as on income. That credit will exclude most Westwood homes as we have high assessed values as well as high taxes in comparison with state averages.

Another objection is “a preference to assist seniors with local programs that are a controllable cost to the Town, such as the Aid to the Elderly…”

I understand the preference of the Town Government for control with discretionary programs but, in the case of tax assistance for senior homeowners, this has proven to be inadequate and unreliable. The Select Board has only made small discretionary contributions to the Aid to the Elderly & Disabled charity since it was established, in recent years about $50 thousand from the Select Board Reserve fund. A formula-based exemption will be more reliable and, for the Clause 41C1/2 exemption, more generous. Also, the preference for control means giving up the state reimbursement available for the state authorized exemption.

Summary on Senior Exemptions

The existing Westwood tax relief programs for seniors reach only a small fraction of the senior homeowners in the Town and the senior exemption approved in 2000 remains a promise that was not kept. We can and should do better for our seniors. The Clause 41C1/2 exemption is a way to do this with partial state reimbursement and this will be greatly appreciated by the senior homeowners who are struggling with fixed incomes, taxes and inflation.

For more information see:

Taxpayer’s Guide to Local Property Tax Exemptions- Seniors

“Taxpayer’s Guide to Local Property Tax Exemptions- Surviving Spouses”

Finance and Warrant Commission 2022 Annual Report

Thanks to Professor Peter T. Ittig for contributing this opinion article to Westwood Minute.