Image

In Norfolk County in 2025, both real estate activity and property sales prices increased from their 2024 levels while the number of foreclosures significantly decreased, announced Norfolk County Register of Deeds William P. O’Donnell this week.

A total of 16,906 deeds were recorded in 2025, representing an increase of 7% in commercial and residential real estate sales and transfers.

The highest number of property sales in 2025 was in the month of June, with 1,012 transactions. June 2025 also saw the greatest increase in sales - up 13% compared to that same month in the prior year. Overall, property sales increased 3% in 2025 compared to 2024.

The average sales price of both commercial and residential properties was $1,216,895, a 6% increase from 2024. The month of November showed the largest year‑over‑year change - an increase of 46% when comparing November 2024 to November 2025.

“Norfolk County remains an attractive place to live and work, and that continued interest is reflected in the sales prices we recorded in 2025,” stated Register O’Donnell. “At the same time, limited inventory in many communities continues to make the market challenging, particularly for first‑time homebuyers. While we did see a few signs of price moderation in certain months, overall demand remains high, and that demand continues to outpace available housing.”

Overall lending activity in Norfolk County also increased in 2025 compared to 2024. A total of 17,652 mortgages were recorded, up 14% in 2025 from the previous year. December was the month showing the greatest increase in lending activity, increasing 29% in December 2025 compared to December 2024.

“Mortgage activity increased noticeably in 2025, helped in part by modest declines in interest rates during the fall,” said Register O’Donnell. “Even though rates remain higher than what we saw a few years ago, many homeowners and buyers still found opportunities to refinance or secure financing for new purchases. . . .”

Foreclosures were notably reduced in 2025 compared to 2024. In 2025, there were 56 foreclosure deeds recorded. In 2024, there were 87 recorded. Also in 2025, there were 274 notices to foreclose - the first step in the foreclosure process - compared to the 380 recorded in 2024.

“The considerable reduction in foreclosure activity during 2025 is an encouraging sign. With that said, we must remember that foreclosure activity has a human impact, and there are still a number of our neighbors who have lost their homes, and even more are dangerously close to losing their homes,” said Register O'Donnell. “I would urge anyone struggling to pay their mortgage or who knows someone who is struggling to contact one of the non-profit organizations listed on our website, www.norfolkdeeds.org.”

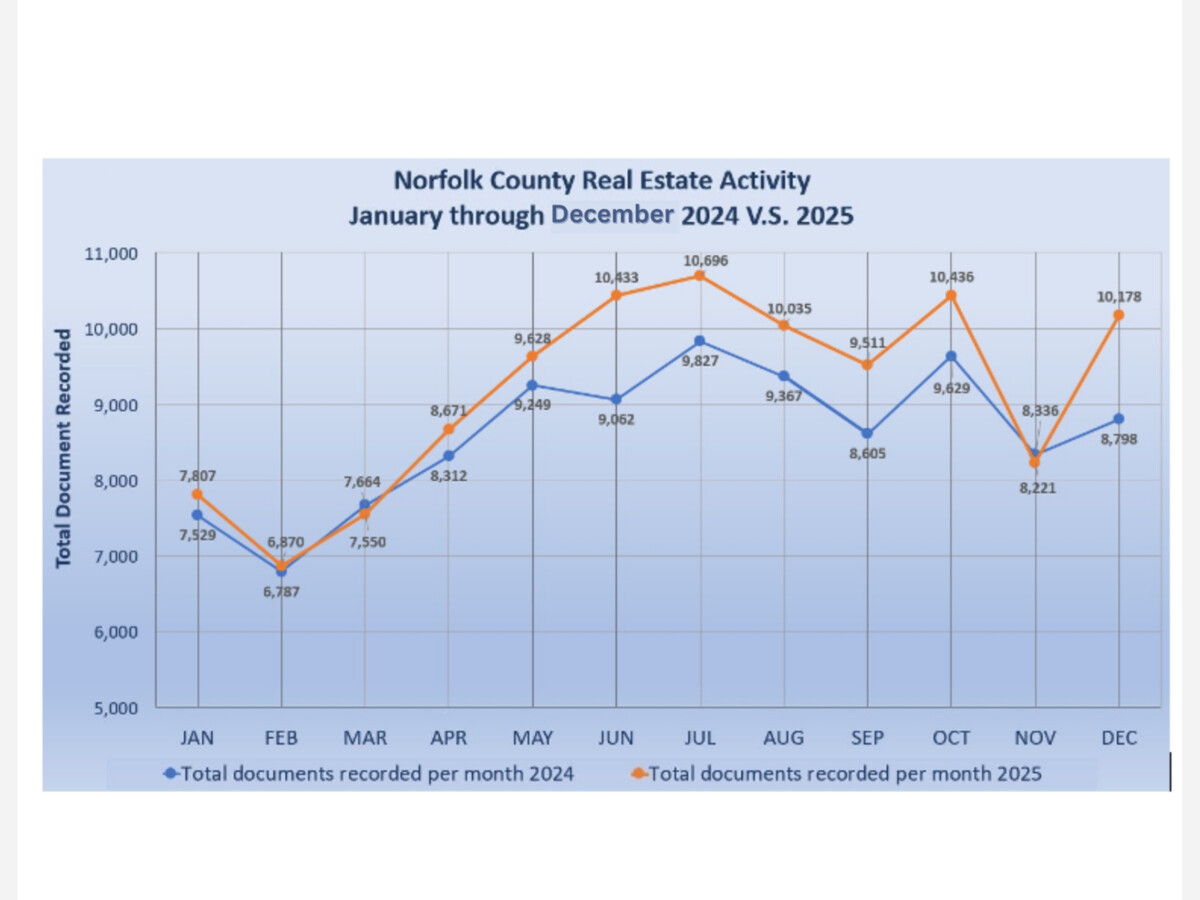

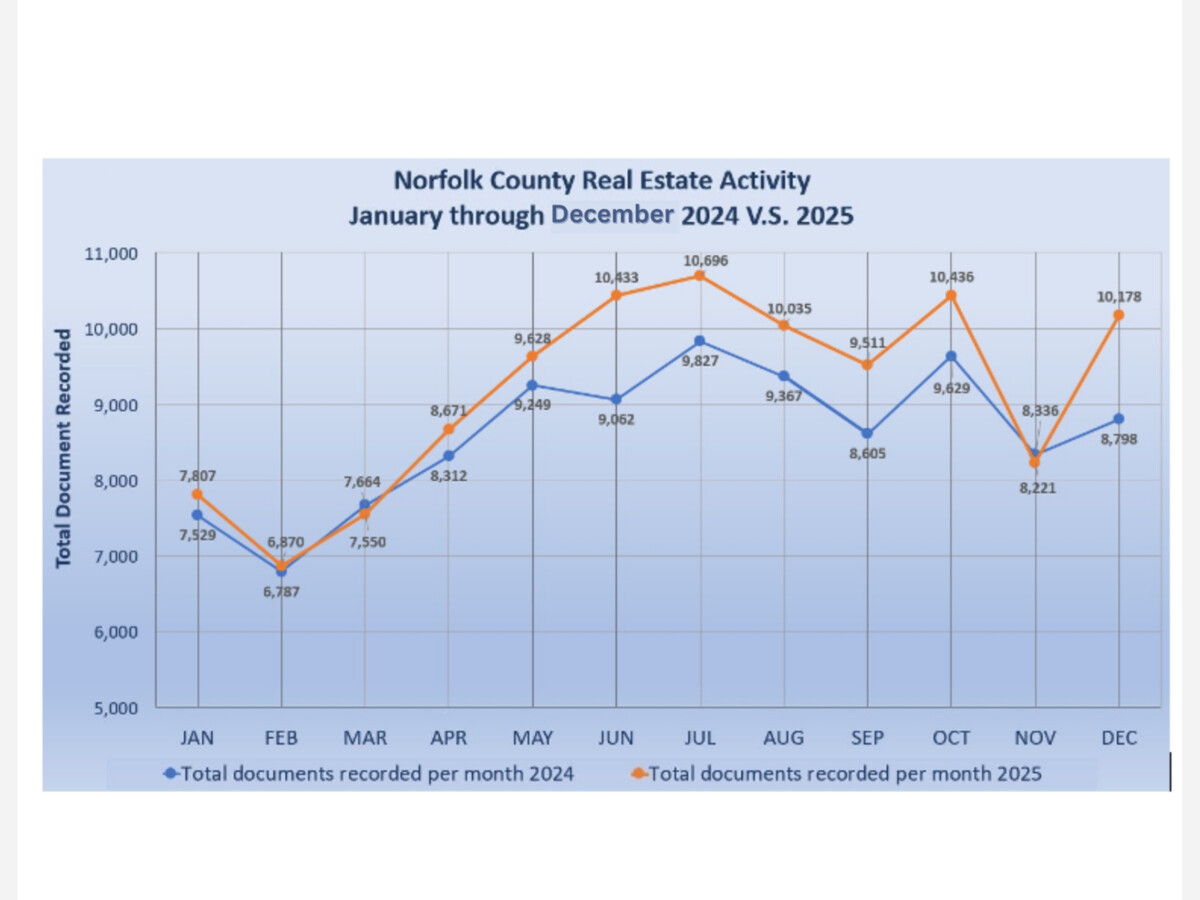

In 2025, a total of 110,561 documents were recorded at the Norfolk County Registry of Deeds, a 7% increase from 2024. July was the busiest month of the year, with 10,696 documents recorded.

“The trends we saw throughout 2025 reflect a real sense of stability and continued interest in Norfolk County’s real estate market,” said Register O’Donnell. “As we move into 2026, we remain hopeful that this momentum will continue.”

Thanks to Norfolk County Registry of Deeds for contributing its news to Westwood Minute.